INTERNATIONAL LOGISTICS 2022 REVIEW AND 2023 PERSPECTIVES

After two historic years in terms of rates and volumes, the end of 2022 saw a return to freight rates equivalent to 2019 on several shipping lines and declining volumes. The year 2023 begins in a climate of uncertainty with a more measured perspective.

2022 : A YEAR IN TWO STAGES

In line with 2021, 2022 started with global port congestion, very high freight rates and strong consumption in developed countries. This situation lasted until the summer of 2022.

The USA experienced extraordinary congestion in the first half of the year at West Coast terminals, which gradually spread to the East Coast. The major ports of Northern Europe and Asia were also affected by major port and land congestion, but also by strong strike movements in Germany, France, Spain, the United Kingdom and South Korea, accentuating the disorganization of logistics.

Faced with port congestion, many shippers have turned to air freight to speed up their deliveries. As a result, the sector recorded a significant increase in volumes, as did rail and road freight.

Several events brought this period to a halt, and the second half of 2022 saw freight rates and volumes fall sharply from September onwards:

- The war in Ukraine

- The zero Covid policy in China

- Global inflation

- The energy crisis in Europe

The war in Ukraine has had many repercussions on international organization patterns (see our full article International logistics in the face of the war in Ukraine).

The EU sanctions against Russia have impacted energy costs in Europe, adding to global inflation and contributing to the overall decline in consumption.

The strict zero Covid policy maintained by China until early December disrupted production and the country's economic growth fell sharply. Considered as the world's factory, the entire supply chain has been disrupted with cancellations of calls, delivery delays due to port congestion, shortages of equipment and raw materials.

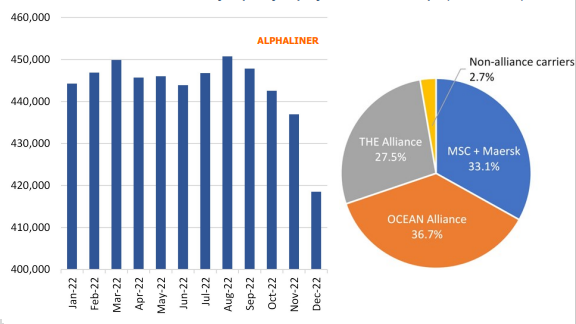

Below is a graph showing the decrease in capacity deployed by shipping lines on the Asia-Europe route and the breakdown by alliance (source Alphaliner).

The Europe-US axis remained on the rise until the end of the year, but the inflation affecting the country as well and the protectionist policy of the Biden administration suggest a drop in volumes on this axis as well.

UNCERTAIN PERSPECTIVES FOR 2023

Global economic growth is expected to decline sharply and inflation, while appearing to stabilize somewhat, remains at high levels, resulting in lower consumption. With inventories at their highest levels for many importers, international trade is down both by sea and by air.

Several analysts agree that 2023 will be a mirror image of 2022. The first half of the year is expected to be down compared to last year, but there could be an upturn in activity in the second half of 2023.

Some uncertainties remain, however:

- China has relaxed its Covid management policy and cases of infection are increasing significantly in the country. Vaccination coverage is not sufficiently high, and labor shortages and factory closures are common in the face of the rapid spread of the virus.

- Tense international relations in the Asia-Pacific region. Many shipping routes pass through these waters and could be significantly disrupted if the situation changes. This would impact the rest of the supply chain

- The Ukraine-Russia war: no outcome has yet been announced by the two countries and the evolution of this conflict could, directly or indirectly, disrupt the supply chain.

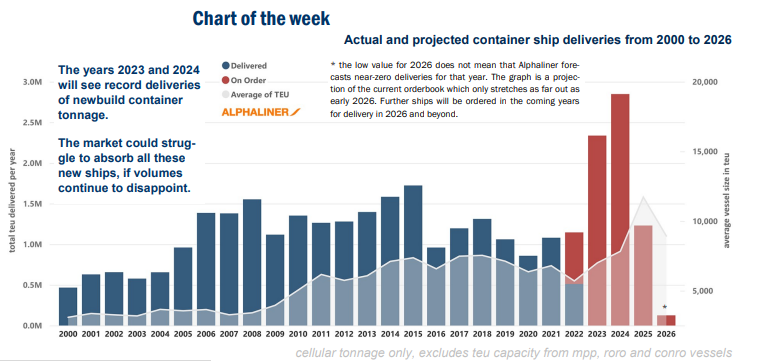

Beyond the economic and geopolitical context, the ecological aspect has direct repercussions for the logistics and transport sectors. Shipping companies must adapt their fleets to the new environmental requirements. New capacities will arrive on the market in 2023 and 2024 following the strong demand of the last two years. These will mainly compensate for the decrease in existing capacity following the IMO regulations that came into force on January 1, 2023. This regulation requires shipping companies to equip each of their vessels in accordance with current standards in order to achieve the objective of reducing CO2 emissions by 40% by 2030 (see our full article: OMI Regulations: What's changing in 2023).

The graph below shows the increase in capacity between 2000 and 2026 (capacities for 2026 have yet to be updated with future orders from shipowners). There is a peak in orders in 2023 and 2024 (source Alphaliner).

It should be noted that all transport sectors (air, road, maritime) are concerned by the objectives of reducing carbon emissions.

In France, the government has increased its budget to find solutions to decarbonize the aviation sector. With IATA's commitment to reduce net CO2 emissions to zero by 2050, many players in the aviation industry are working on green fuels or electric power to achieve this goal.

In line with greener transport, rail freight is still undergoing change in many countries, particularly in France. This mode of transport meets the environmental challenges of lowering CO2 emissions and would provide an additional solution to road transport in several regions.

Road freight, despite the announced decrease in volumes, will have to face difficulties that are already known in 2022: labor shortage, high fuel costs, gradual compliance of the truck fleet to meet decarbonization objectives (reduction of greenhouse gas emissions by 55% by 2030).

Finally, French port infrastructures are developing and modernizing: work to facilitate access to barges in order to increase loading and unloading capacities for Haropa Port, reinforcement of quays by the GPMM, and changes to port equipment such as the electrification of quays. Haropa Port and GPMM are counting on an increase in their volume in 2023.

As a year of transition, 2023 begins in an uncertain context, which does not, however, rule out an upturn in activity for the second half of the year.

Our teams remain available and continue to support and advise you on a daily basis. Do not hesitate to contact us for all your international shipping projects.

Tags: BALGUERIE