INTERNATIONAL LOGISTICS

Review of 2021 and perspectives for 2022

Described by experts as a record year, 2021 was marked by a supply chain in difficulty due to significant growth in developed countries, unprecedented volumes of containers handled and the global health crisis. In this context, what is the perspectives for 2022?

Review of the year 2021

With global economic growth of over 5% for the year, consumption has increased considerably in Western countries. Faced with very strong demand from the American continent and Europe, and a supply that was struggling to keep up, freight rates were multiplied by eight, reaching records.

Of course, the COVID-19 pandemic caused the closure of terminals and factories, particularly in China. This strict crisis management policy had an impact on production times, which in turn affected all international logistics.

The increase in demand, the health crisis and other factors such as the blocking of the Suez Canal by a ship, the shortage of truck drivers or the lack of infrastructure in the terminals, led to such a high level of port congestion that we reached more than 300 ships waiting off the world's largest ports, in the second half of the year. French terminals were also saturated at the end of the year. To limit the lengthening of delays, we have seen a large number of changes in the routing of vessels to secondary ports, and repeated blanks sailings.

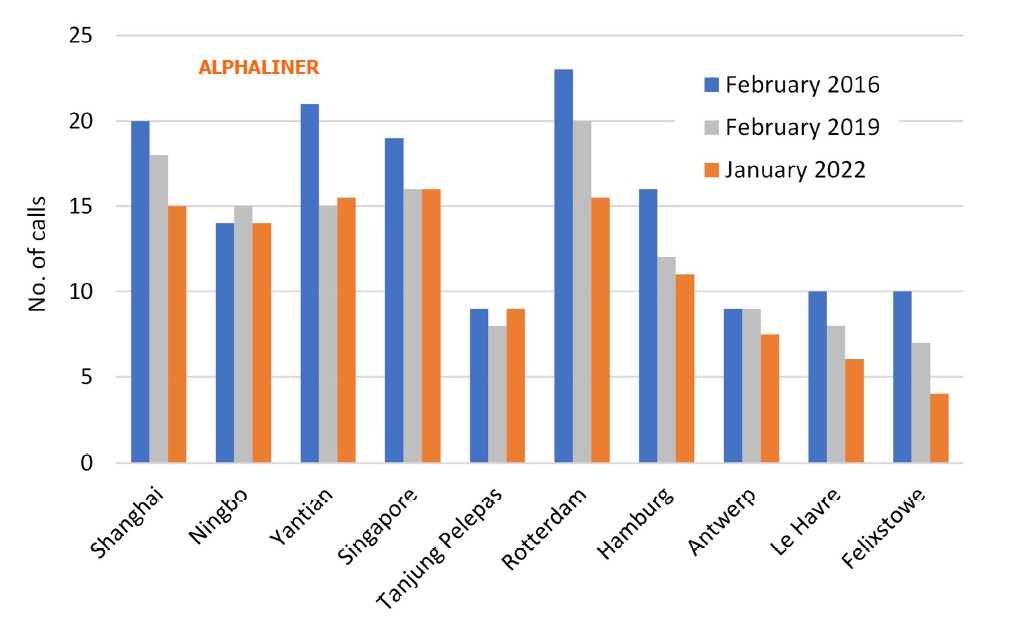

The graph below shows the decrease in the number of weekly calls from the Far East to Northern Europe in the five largest ports in Asia and Northern Europe, from 151 in February 2016 to 113 in January 2022.

This disruption has led to shortages of raw materials around the world and a chronic deficit of empty containers in Asia. The players in the supply chain have tried to compensate with air and rail traffic, which have seen a sharp increase in volume. But this is far from being enough to stop the bottlenecks that are still very present at the beginning of the year.

Regarding the explosion of freight rates throughout the year, a stabilization has been observed in the 4th quarter of 2021, although it remains at a high level.

Perspectives 2022

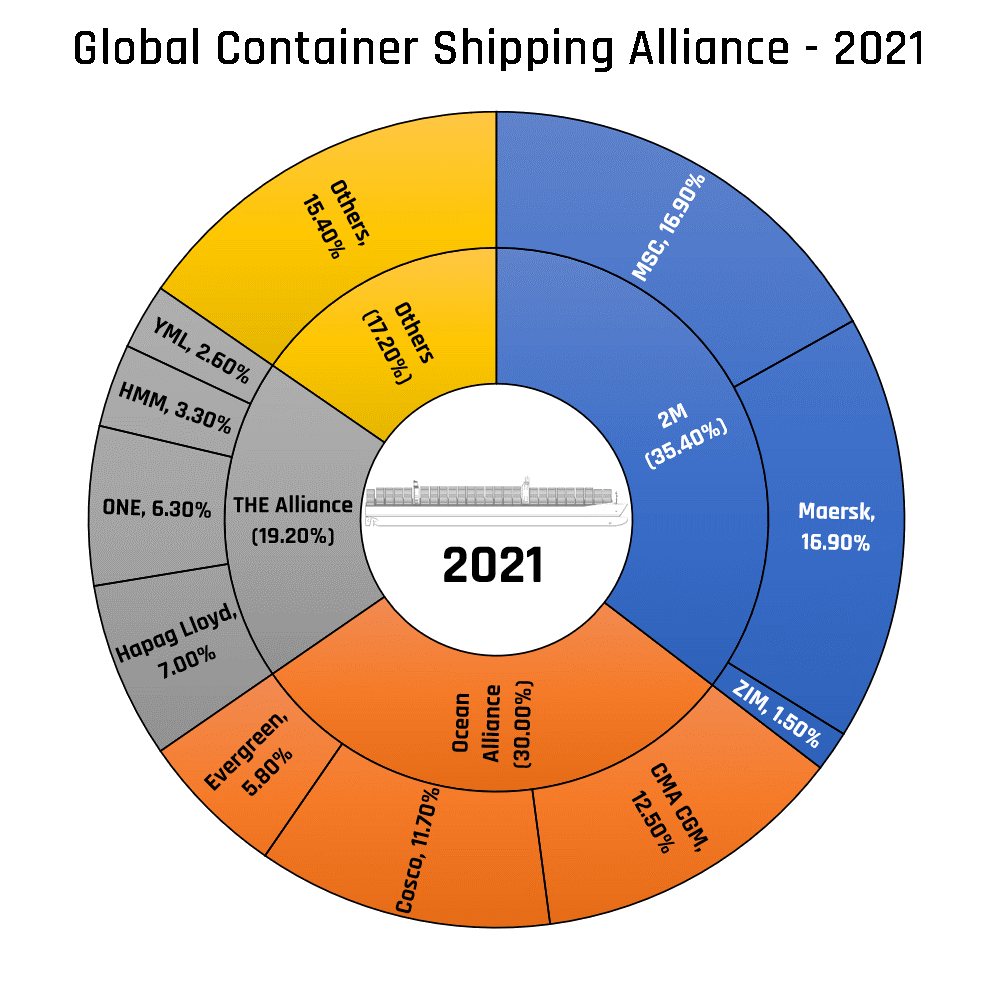

Faced with last year's disruption, shipping lines invested in the deployment of new capacity, allowing them to meet demand, which will however only be added to the market in 2023 (+7% expected). With limited capacity growth in 2022, the pressure on freight rates is likely to remain, and thus contribute to maintaining high levels, particularly in container transport. All the more so since supply has been contracting over the past ten years, as the chart below confirms for 2021. The three main alliances control over 84% of the container market.

In addition, shipowners will be looking to the United States this year, where demand is expected to be just as strong as in 2021. Indeed, with growth predicted to be between 3% and 4% in the country, the market between China and the USA will continue to be tight.

More generally, with GDP expected to increase in 2022 in developed countries, and monetary support from governments for consumption still strong, supply chain disruptions could continue.

Added to this is the COVID-19 pandemic and particularly the very active OMICRON variant around the world, which does not improve traffic flow, and remains an unknown in the forecast for this new year.

We must not forget the decarbonization objectives in the transport sector imposed by the IMO, and the various agreements between countries, with an increasingly precise and pressing agenda. Even if the changes will take place over several years, this will require shipping companies to gradually adapt their entire fleet to meet the new requirements, and will surely have an impact on volumes.

The saturation observed in 2021 will have allowed governments and various logistics players to make decisions to develop infrastructures and meet the constantly increasing supply. Thus, airlines are expanding and ordering new units. Rail freight is also changing in many countries. This alternative not only responds to current environmental concerns, but also helps to alleviate labor shortages in road transport and optimize terminal congestion.

France has included this change in its recovery plan to "green" the activity and develop port infrastructures. Haropa Port will thus benefit from State aid and private investments that will enable it to improve its infrastructures and its offer. In particular, rail and river services. In the same vein, Eurofos has also adopted a strategic project for the year 2021, which will run until 2024, with digital and ecological transitions at the heart of the program.

According to analysts the current complex situation will last at least until the summer of 2022 with a somewhat cushioned impact, as many companies have adapted to the delivery times of goods, and can therefore change their supply chain accordingly.

As long as demand remains strong, no decrease in freight rates can be expected

A year that therefore starts in a complex situation inherited from 2021, with the expectation of an improvement at the end of this 1st half.

All our teams remain involved and available. Thank you to all our customers for trusting us throughout a year 2021 with many twists and turns, and for continuing to entrust us with their shipments for this new year.

Tags: LE GROUPE BALGUERIE BALGUERIE